The arrival and subsequent impact of the current coronavirus crisis has taken many organizations and states unawares.

This phenomenon can be best explained as the appearance of a metaphorical “black swan”. The theory goes that human beings will assume that, because all the swans they have seen in their life are white, all swans must be white. It is a classic error of induction resulting from one’s limited experience in life (I have not seen it) or from one’s cognitive biases (I do not want to admit that I have seen it).

As a matter of fact, the error arises from an individual or entity having been blind, having been unprepared “not having seen it coming”, or not having considered “unknowns”, as Donald Rumsfeld put it.

Nassim Taleb, Researcher and Risk Analyst, identifies three reasons why we do not see these events coming:

- The world is too complicated and random to understand what is really going on;

- We are very good at making sense of events after they have happened; and

- Putting elements into categories (which we do to make sense of things) always oversimplifies reality.

As we can see from the events unfolding today, this blindness can have a severe impact on human society.

How can companies avoid these “black swans”?

First of all, let’s make the distinction between (1) risks – that are manageable; and (2) uncertainties – that are unpredictable.

- Let’s define risks as events that may be predicted, monitored, hedged, insured or avoided. In today’s corporate world, risks are studied, measured, and even exploited. The risks that fall into the category of “high probability and small impact” are considered part of the daily management of operations. These are the responsibility not only of the risk manager but of each front-line manager who is in charge of dealing with those manageable risks.

- Let’s define uncertainties as unknowns. By definition, we cannot know the nature, the size, the timing, … or anything, about these unknowns. Companies cannot find on the market an insurance policy that adequately covers events with a “very low probability and a very high impact”.

The audit committee today is in charge of risk monitoring. They establish a strong communication line with the company’s risk manager to ensure the board’s risk appetite and the field risk mitigation are aligned. This will ensure that manageable risks are well monitored through sound processes. As we know, moderate risks lead to good business and a healthy company.

As the Danish proverb goes “forecasting is difficult, especially when it concerns the future”. The audit committee should, therefore, approach the subject of uncertainties in a different manner: leaving the path of prediction and taking the path of agility, seizing opportunities, and avoiding rationality and argumentation.

- Maintaining agility means:

- training the muscles of the corporate strategy: design various scenarios;

- Ensuring the adaptability of the organization: encourage speed of reaction;

- Promoting the flexibility of the people and systems: break silos and develop networks.

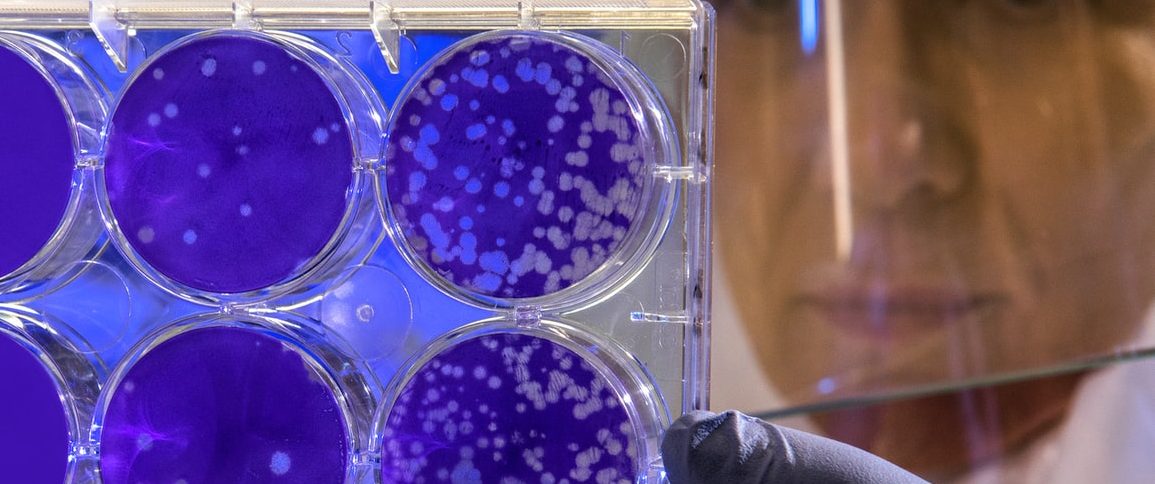

- “Chance favors the prepared” said the French scientist Louis Pasteur. Opportunities are seized by companies that are vigilant. The board should foster the company’s exposure to positive contingencies that might be as beneficial as negative contingencies might be hurtful.

- Avoid rationality and argumentation since, as Taleb explained, relying on it is the very reason why boards and audit committees do not see these “black swans” coming.

Xavier BEDORET – July 2020